1. Getting Started

Expense System Requirments

The online expense form is supported by the following platforms:

- Laptop or Desktop computer (Windows, MacOS)

- Mobile or tablet (iPhone & Android)

- The latest version of Google Chrome or Microsoft Edge are recommended

Expense Eligibility Requirements

The following criteria must be met before submitting an expense:

- You have attended the event.

- The expenses you are claiming are allowed for the event.

- Your expense claim is submitted within 60 days of the event.

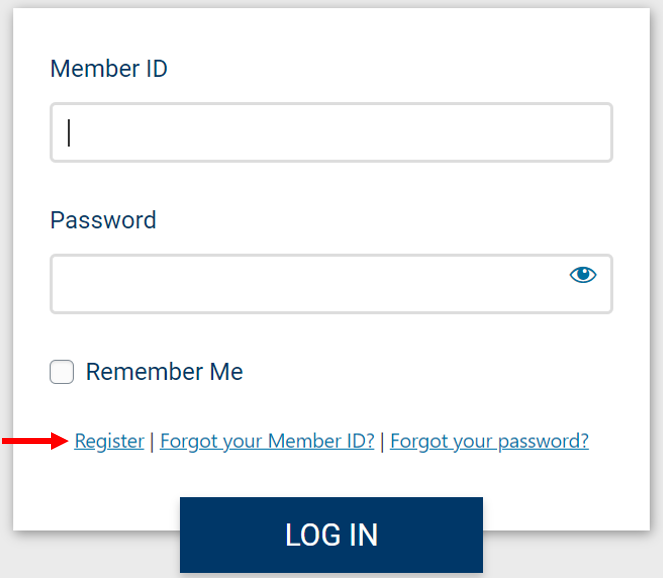

Accessing the Expenses Menu

Go to member.hsaa.ca and log in with your Member ID and password. If you do not have a member account, you will need to create one. To do so, click Register from the HSAA website login screen.

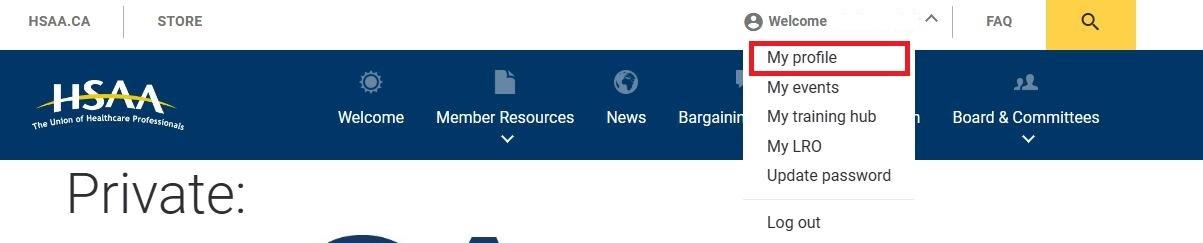

Once you have successfully logged in, click on the Welcome [YOUR NAME] drop-down menu and select My profile. You will be redirected to the Memberlink Homepage.

2. Starting a New Expense Claim

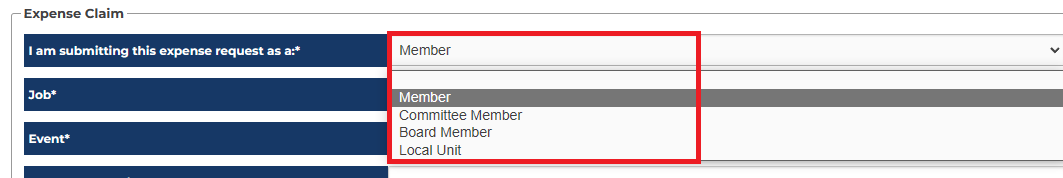

Expense types (Member, Committee, Local Unit, Board)

Depending on the active union positions you hold, there may be 1 or several options for expense type.

- Member – this is available to all active HSAA members

- Committee Member – available to any HSAA member that is part of an active committee.

- Local Unit – available to all Local Unit position holders (ie: Chair, treasurer, secretary).

- Board Member – available to any HSAA member holding an active Board position

Depending on the type you choose, your available expense options may be different.

If you are missing an option but currently hold an active committee, board or local unit position, please email membership@hsaa.ca requesting an update to your profile with the position you are currently occupying.

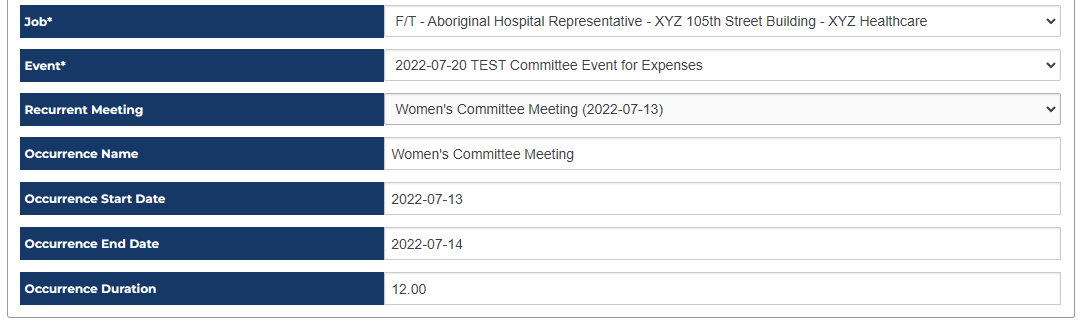

Job & Event selection

If you currently work multiple jobs, select the job for which you attended the event. This is for reporting purposes only, and will not affect the expense options available to you.

In the Event dropdown menu, select the event that you wish to submit expenses for.

- You must be registered for the event.

- You must be marked as attended the event.

- The event must have occurred within the last calendar 60 days.

If you believe you are within the eligibility criteria listed above but do not see the event, please email membership@hsaa.ca and include:

- Your full name

- Your member ID

- The name of the event you attended

- The date of the event

In the case of recurring events, such as board meetings, an option to select the specific meeting will be available when you choose the event. If the meeting is not listed, you may select “other”, and provide the date and duration (in business hours), of the event. Other attendees will then see this newly added meeting and be able to select it when doing their expenses. Eligibility criteria do not apply for recurring events.

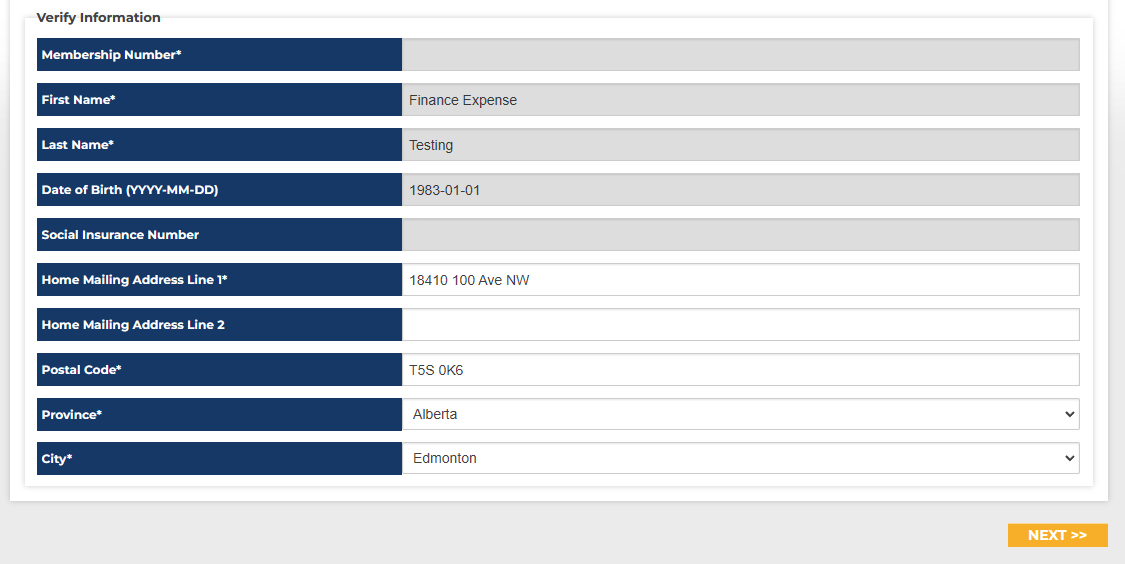

Verification of personal information

If we already have your personal information on record, it will automatically be shown in this section. If we do not, you will be asked to provide the information in the provided fields.

Date of birth and Social Insurance Number are required to process expenses within CRA guidelines.

If your address has changed, please provide the new information on the form provided, and it will be verified and updated on our system.

3. Expense Claim Details

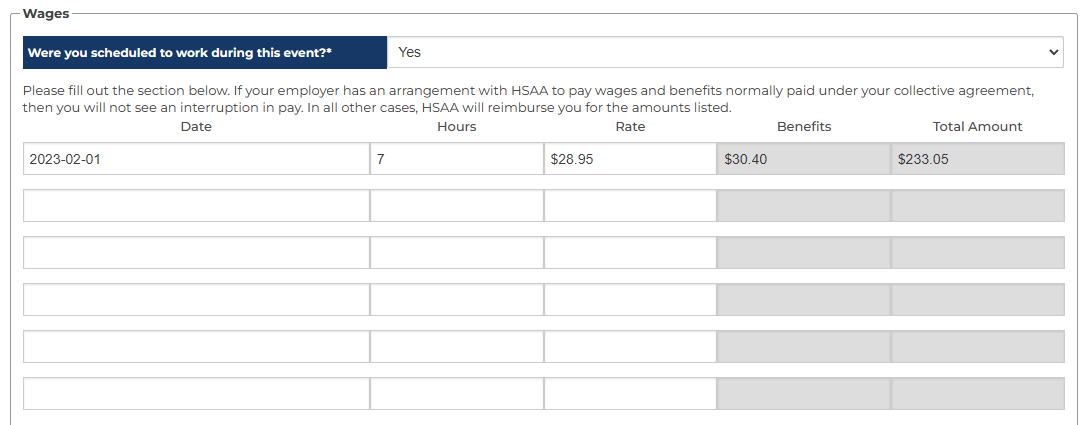

Regular Wage Reimbursement

Wages are broken down into 3 types:

- Wages where you were scheduled to work (paid by employer)

- wages where you were NOT scheduled to work (paid by HSAA)

- Additional wages not paid by your employer (paid by HSAA)

In the Wages section, choose an option (yes or no) for “Were you scheduled to work during this event?”

- If you choose ‘YES’, please indicate the date, hours and hourly rate submitted to your employer for this event. Your employer will reimburse you and invoice HSAA. The Benefits field is an additional 15% added to the total amount to cover the cost of benefits. This information is used for reporting and auditing purposes.

- If you choose ‘NO’, an automatic calculation at a rate of $20/hour for the duration of the event is added to your expense form.

Note: As per HSAA policy, committee and board members are entitled to reimbursement at their full hourly rate even if not scheduled to work. For this reason, they are required to provide the number of hours and hourly rate even if they select ‘NO’ for if they were scheduled to work during the event.

At the bottom of the wages section, use the “Required Documents” field to upload a copy of the “Time Off for Union Business” Form. On a computer, you can click in this section to upload, or drag & drop the document into the section directly. If you’re on a mobile device, you can upload the file from your device or use the camera app to take a picture of the document.

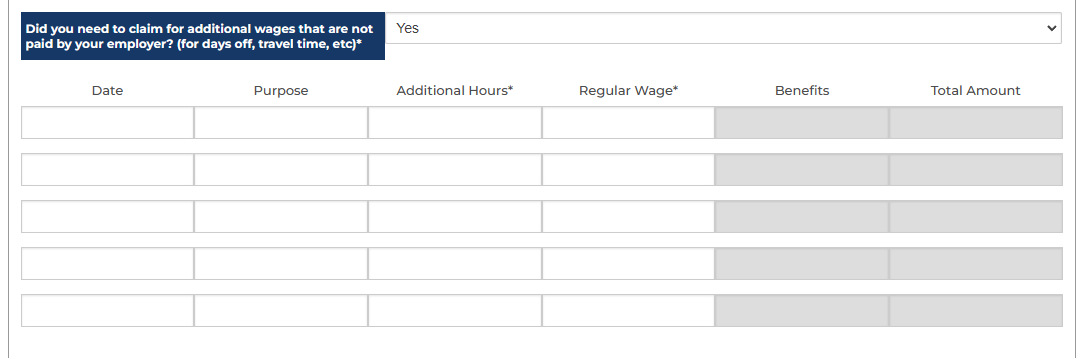

Additional Wages Not Paid by Employer

If you have additional wages that are not paid by your employer, such as travel time, days off, prep time* for the meeting, select ‘YES’. Complete the rows with the required information. These wages will be paid by HSAA in accordance with policy. An additional 15% in lieu of employer benefits will be added to the amounts provided.

*Benefits calculation does not apply to prep time.

Nightly Incidentals

Nightly incidentals are provided for multi-day events, or events that occur after 9:00pm. Please use this section to select the days for which you wish to claim incidentals. The total amount will be calculated automatically based on National Joint Council rates.*

* Note that not all events or expense types are eligible for nightly incidentals.

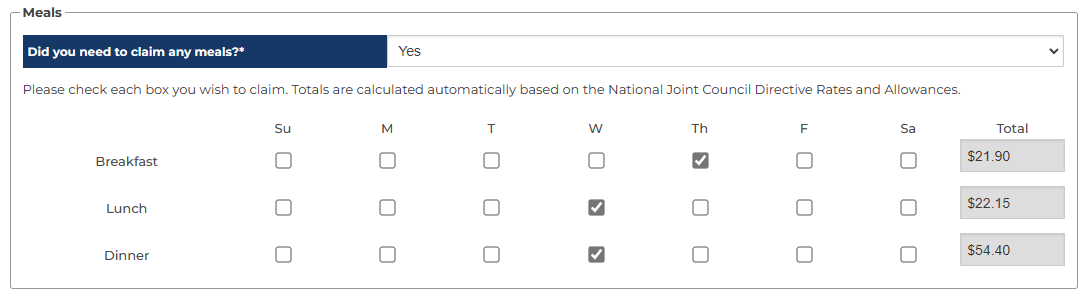

Meals

If you were required to pay out of pocket for meals during the event, select ‘Yes’. Click the boxes for the days and the meals that you wish to claim. The totals will be automatically calculated and added to your expense, based on current National Joint Council Rates.

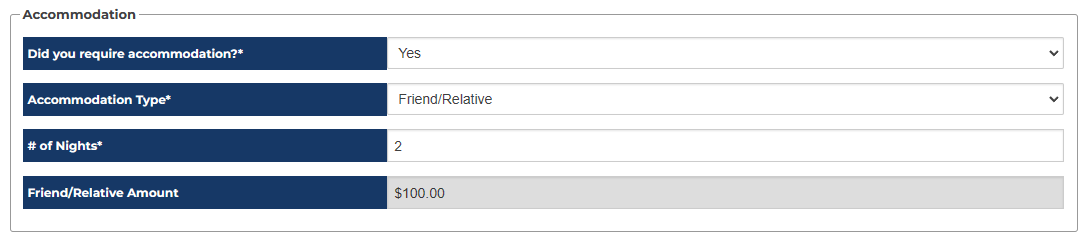

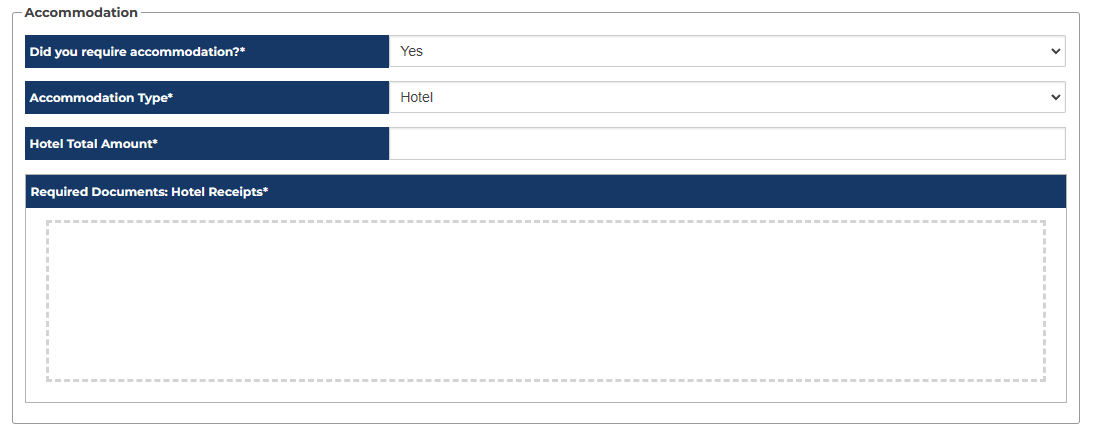

Accommodations

If you were required to stay overnight in order to attend the event, select ‘Yes’ for accommodation.

If you stayed with a friend or relative, you will be reimbursed at a rate of $50 per night.

If you stayed in a hotel and were required to pay out of pocket, select ‘Hotel’ as the accommodation type and include the total amount of the hotel invoice. Using the documents section, upload a copy of the hotel invoice. On a computer, you can click to upload the document, or drag & drop the file into the document upload section. From a mobile device, you can use your camera to take a photo of the invoice for submission.

Travel

If you were required to travel to attend the event, select ‘YES’ for travel expenses.

There are several options for travel expenses:

- Flight – expenses from using an airline service

- Taxi/Uber – expenses from using a taxi or ridesharing service

- Bus – expenses from using a public or chartered transportation service

- Personal vehicle (as passenger) – expenses allowed through travel to the event as a passenger

- Personal vehicle (as driver) – expenses allowed through travel to the event as a driver

- Car Rental (including gas) – expenses allowed through the rental of a vehicle to attend the event

Select all that apply.

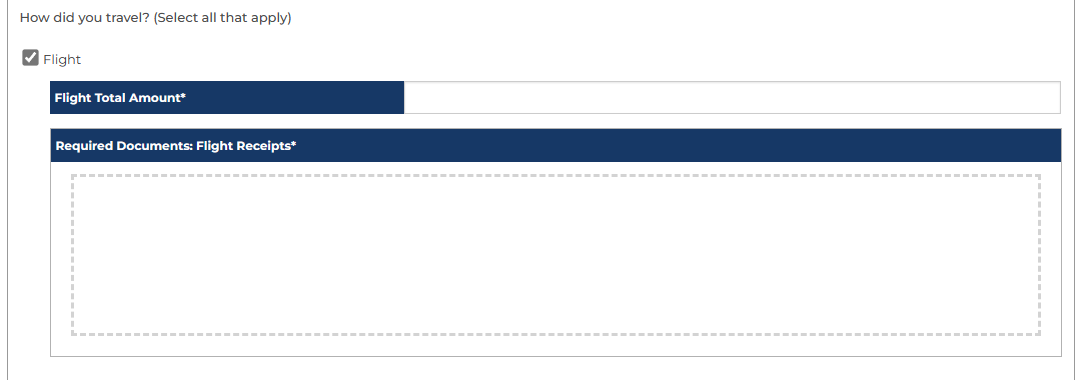

For flights, provide the total amount of the flight, including any baggage costs, car parking, etc. If there were additional travel costs to/from the airport, such as a taxi or driving, select the additional travel method and assign the costs there. Be sure to include a note at the end of the expense with a description of the travel arrangement. Upload receipts into the Flight Receipts section*.

For Taxi/Uber, provide the total amount of the taxi cost and upload receipts into the required documents window*.

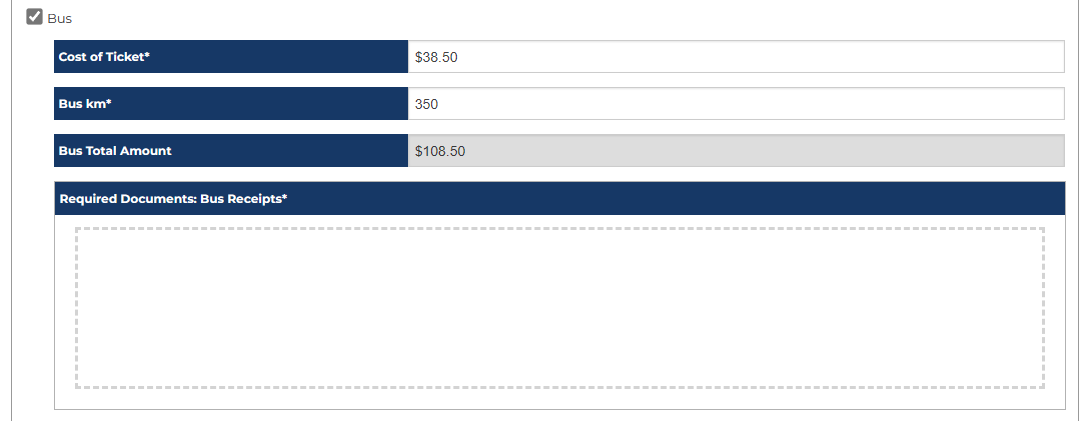

If you took a Bus to travel to the event, select the Bus option, provide the total cost of the bus ticket, number of kilometers travelled by bus, and upload the receipts into the bus receipts window*. The total reimbursement will be calculated automatically.

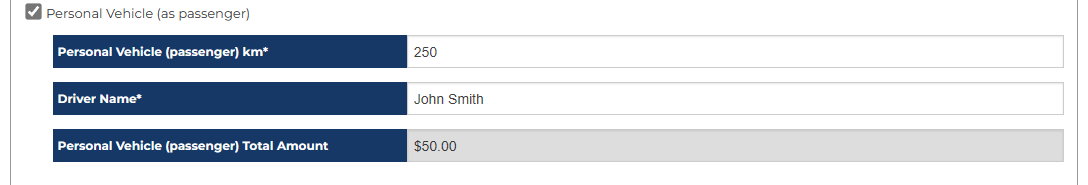

If you arrived to the event as a passenger in a vehicle, select the option “Personal Vehicle (as passenger)”, provide the total number of kilometers you travelled for and the full name of the driver. The total reimbursement amount will be calculated automatically based on current rates.

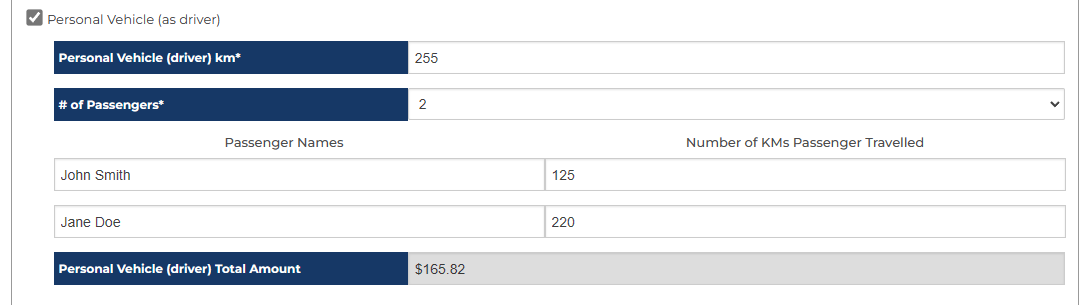

If you drove to the event, provide the number of kilometer’s driven from your place of residence to the event location/hotel. If you had passengers attending the event, provide their full names and the number of kilometers they travelled with you. The total amount will be calculated using National Joint Council Rates.

*In cases where receipts are required, click to upload the document into the required documents window, or drag & drop the file into the window. If using a mobile device, click on the required documents section to use your camera app and take a photo of the receipt.

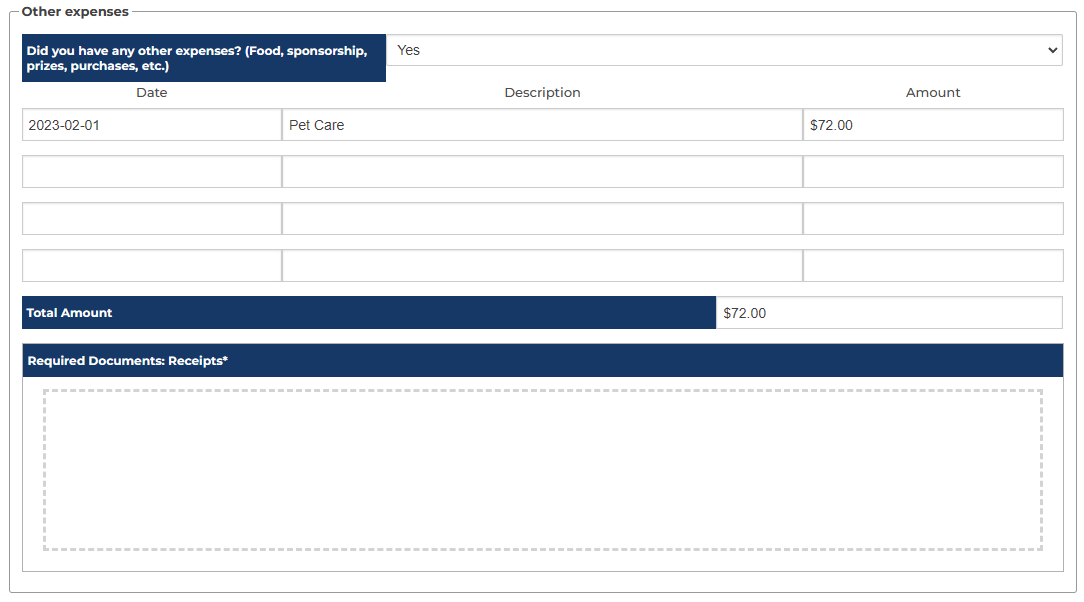

Other Expenses

If you incurred any additional expenses not covered in the above sections in order to attend the event, select ‘YES’. Provide the date of the event, description of the expense to be reimbursed and the total amount. In the Receipts section, upload the receipts for each additional expense.

Additional Notes

In order to ensure your expense is approved for payment in a timely manner, please include any additional information that may be relevant to the approval process.

4. Signing and Submitting Your Expense Claim

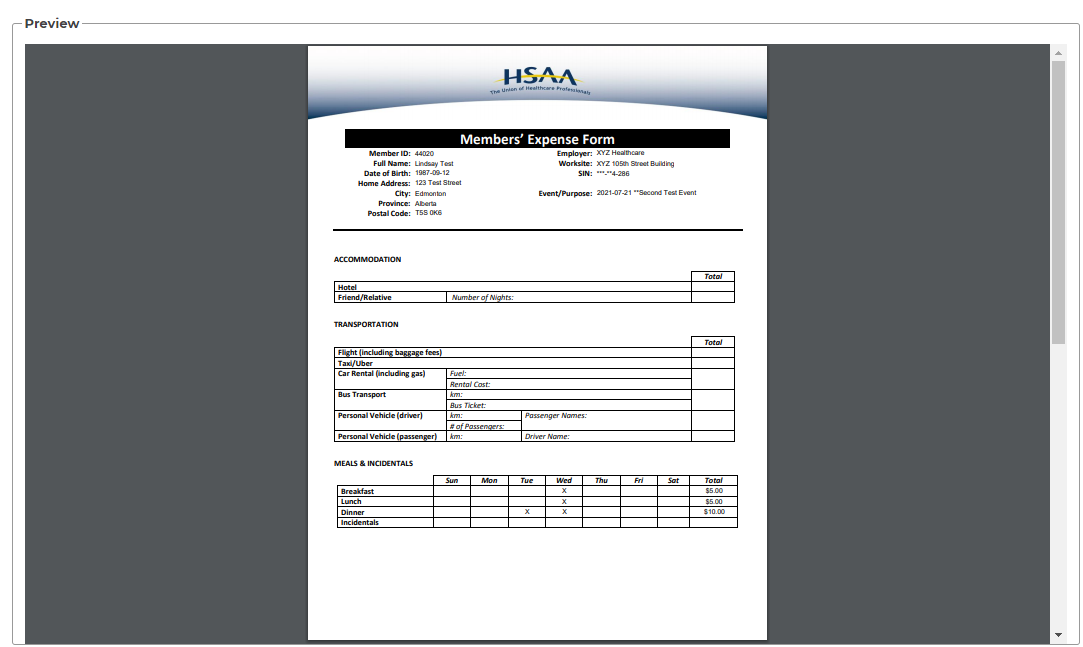

Review of Expense Claim Record

Once the expense section has been filled out, a PDF form will be generated as a record of the expense which includes all the supplied amounts. In this window, you can review the amounts to verify that the claim is complete. If you are satisfied with the information being provided, move to the signature section.

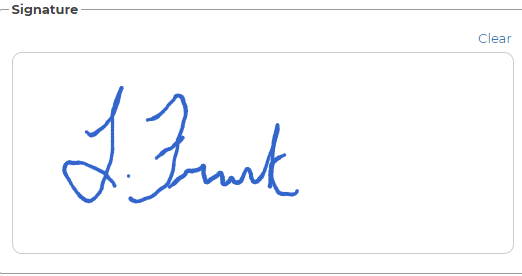

Signing & Submission

Using your mouse (laptop/desktop) or your finger (mobile/tablet/touchscreen), sign the document to verify that the information is accurate and in accordance with HSAA policy. If you need to make any changes, click ‘Back’ to return to the previous screen and adjust.

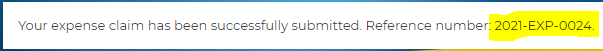

Once signed, click SUBMIT to complete the expense submission process. Please write down the reference number provided on the last screen, and provide that number if you have any questions about the expense.

Submitted claims can be viewed on the Expense Claim status page.

5. Expense Claim status

Overview

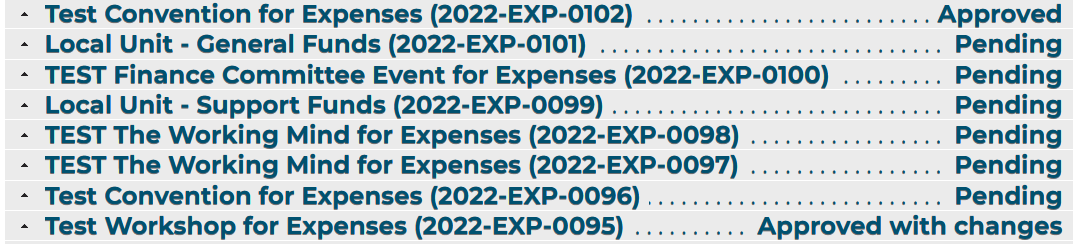

The expense claim status page is a website that lists all online expense claims submitted under your profile.

- The list will be ordered chronologically in the order it was received (newest at the top)

- Expense claims will be identified by the event they are claimed for, the reference number, and their status.

- There are 5 possible status options for every expense

- Pending – the expense is submitted but not yet approved

- Approved – the expense is approved and submitted to finance for processing & payment

- Approved with changes – the expense is approved, but there were changes to the amounts requested. A note will be included that explains the change

- Denied – the expense is denied and will need to be resubmitted. A note will be included that explains the reason for the denial.

- Paid – the expense has been processed for payment. You should expect the amount to be received in 5-10 business days.

- You can click on any expense claim to expand and view a detailed breakdown of the included amounts, along with any changes and payment information as it becomes available. For more information, see 5.02 – Understanding your Expense Claim Status section.

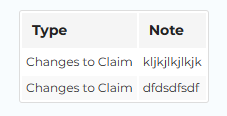

Understanding your Expense Claim Status

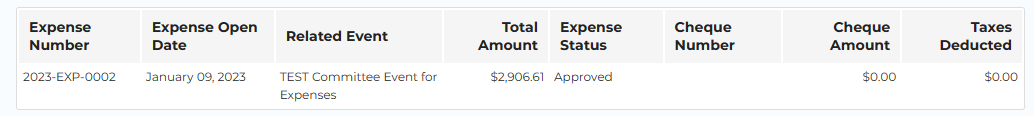

The expense claim status breakdown includes two tables.

The first table displays an overview of the expense, including:

- Expense reference number

- Expense submission date

- Event tied to the expense

- Total expense amount to be paid by HSAA

- Processed payment information detail

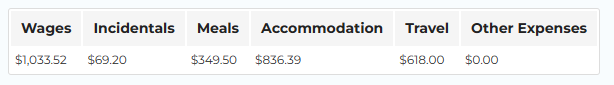

The second table further breaks down the total amount into applicable expenses:

- Wages (HSAA paid only)

- Incidentals

- Meals

- Accommodation

- Travel

- Other Expenses

If there is adjustment to the claim, the amounts will be updated to reflect that, and there will be a note section that details the changes.

No changes to the expense claim can be made by the member once submitted. Any inquiries should be directed to Finance@hsaa.ca.